As momentum, a shifting currency tide and now even sentiment – continues to work against the grain of a slouching equity market structure, many market participants are now just beginning to question if the bull’s ship has finally sailed. In a week full of emotion and frustration extending from the presidential, congressional and senatorial elections, there is a surplus of pundit causations to fit every wiggle with each tail. And although some of these may have logical underpinnings, like good propaganda – a seed of truth and convenient correlation is stretched far beyond legitimacy.

Perhaps I overestimate the great distiller of outcomes that is the financial markets, but have found little merit in pinning the perceived surprise of short term market gyrations to an event as protracted as the US presidential elections. Alas, it is my belief – based on my own cycle and comparative work – that the weakness in equities this past week was the byproduct of ongoing asset kinetics set in motion long ago.

Below are several charts I have been following from comparative market environments that continues to point towards market weakness – both in equities and commodities – and a resurrected US currency that I fear has yet to be factored into the collective market consciousness.

______________________________

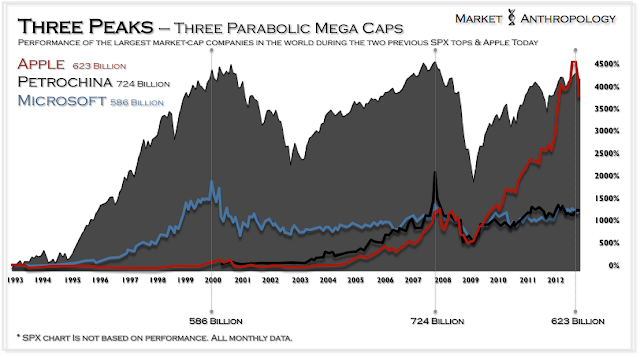

The Nasdaq/S&P 500 comparative continues to closely follow the arc of the 2007 S&P 500 top – with this cycles Petrochina (last Here) being played out by the now exhausted parabolic mega-cap of Apple. Should the analogy to the previous two peaks on the SPX continue, the bull’s ship at best is packed, and at worst – departed.

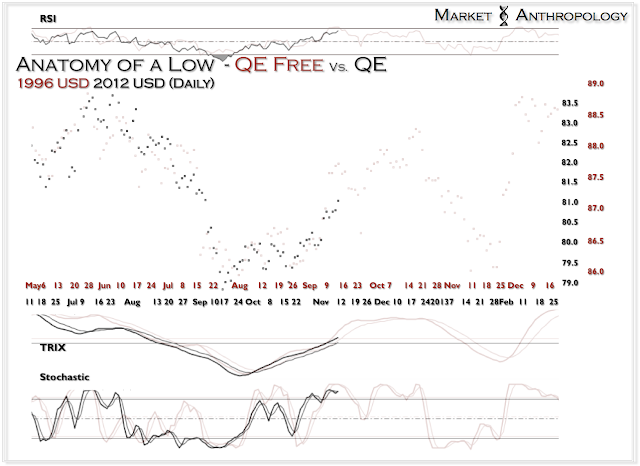

Continuing to follow the arc of the last secular low – regardless of influence by our quantitative commanders – the US dollar index recaptured 81 this week. It is my belief that the dollar will continue to strengthen over the coming weeks.

Considering that the precious metals market and the euro are the inverse recipients of US dollar strength; silver and European bourses, such as Spain – continue to follow the arc of the 1991 Nikkei comparative, initially presented this past June in the Trilogy.

As mentioned frequently, the reliable asset relationship of silver leading moves in Europe continued last week.

Both the S&P 500 and its banking sector continue to be strongly repelled from a rare coincident rejection of their respective long-term meridians.

As always – Stay Frosty.